Banking. Reimagined.

Discover a new era of digital banking with iBAN KING, where innovation meets convenience. Experience seamless transactions, secure payments and comprehensive financial solutions all in one place.

Remittance

Transfer money worldwide with transparent pricing and no hidden charges.

Digital Banking

Your complete banking solution, in the palm of your hand.

About iBAN KING

iBAN KING is at the forefront of digital banking innovation, committed to transforming the way you manage your finances. Our mission is to provide secure, efficient and user-friendly banking solutions that empower individuals and businesses worldwide. With a vision to lead the digital banking revolution, we strive to offer unparalleled services that cater to the diverse financial needs of our clients, ensuring a seamless and integrated banking experience.

The Future of Banking

iBAN KING is redefining banking with its state-of-the-art technology, offering a seamless blend of traditional banking and modern digital solutions.

Order Your New Digital Card Today

All in One

Benefits with iBAN KING

- Accessibility: Available to customers globally, regardless of their location.

- Convenience: 24/7 access to banking services through online platforms and mobile apps.

- Lower Fees: Often offer lower fees compared to traditional banks.

- Innovation: Tend to be more innovative and offer advanced features.

- Transparency: Provide clear and transparent pricing and fee structures.

Discover Our Services

Banking Beyond Limits

Payments and Transfers

- Domestic and international money transfers.

- Bill payments and scheduled payments.

- Peer-to-peer (P2P) transfers.

Cards

- Issuing physical and virtual debit cards.

- Manage all your cards in one place, including (freezing/unfreezing cards, setting spending limits, etc.).

- Integration with mobile wallets (Apple Pay, Google Pay, Samsung Pay).

- Tap to Pay: Facilitating contactless payments using NFC technology.

Global Remittances

- Sending money internationally to family and friends.

- Offering competitive exchange rates and low fees for remittances.

FX Integration

- Offering real-time foreign exchange services with competitive rates.

- Holding and managing multiple currencies in one account.

- Making international payments with ease.

Cryptocurrency Services

- Buying, selling and holding cryptocurrencies (Bitcoin, Ethereum, etc.).

- Offering crypto wallets and exchange services.

- Facilitating cryptocurrency transactions.

- Potentially offering crypto-backed loans or other innovative financial products.

Trade Transactions

- Facilitating international trade transactions for businesses.

- Providing tools for managing import/export payments and currency exchange.

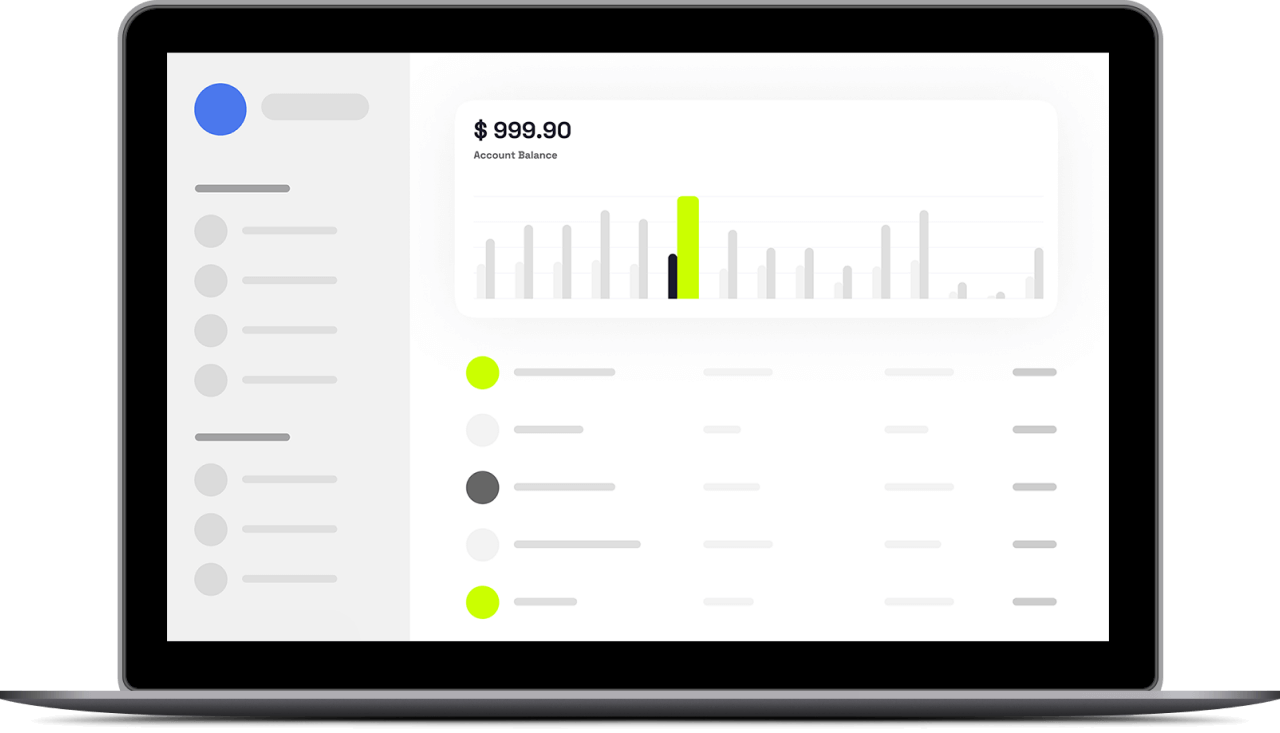

Account Management

- Opening and managing various account types (checking, savings, multi-currency).

- Viewing statements, transaction history and balances online or via mobile app.

- Setting up account alerts and notifications.

Digital Wallet

- Securely storing and managing multiple payment cards and accounts in one place.

- Syncing all cards: Allowing users to add all their existing cards for convenient access and management.

Lending

- Providing various loan options (personal loans, business loans, etc.).

- Offering credit lines and overdraft facilities.

Investment Options

- Offering investment products and services (robo-advisors, investment accounts, etc.).

- Providing access to financial markets and trading platforms.

Deposits

- Making deposits via various methods (bank transfers, mobile check deposit, etc.).

- Accessing different deposit account options.

Value-Added Services

- Budgeting and Financial Management Tools: Helping users track spending, set financial goals and manage their finances.

- Personalized Insights and Recommendations: Providing tailored financial advice and recommendations based on user data.

- Customer Support: Offering 24/7 customer support through various channels (chat, email, phone).

- Security: Implementing robust security measures to protect user data and funds.

By offering a wide range of services and leveraging technology, iBAN KING is transforming the banking experience for individuals and businesses worldwide.

No. of Employees Globally

Deposits

Live Users

Our Presence

iBAN KING Global Coverage

- Bangladesh

- Egypt

- India

- Nepal

- Oman

- Pakistan

- Qatar

- Saudi Arabia

- Singapore

- United Arab Emirates

- United Kingdom

FAQ

Is my money safe in a digital bank?

Absolutely. Digital banks are held to the same security standards as traditional banks. They use advanced encryption, multi-factor authentication and other security measures to protect your funds and personal information. Many digital banks are also regulated by the same authorities as traditional banks, providing further assurance of their safety and security.

What are the benefits of using a digital bank?

Digital banks offer several advantages over traditional banks, including:

- Convenience: 24/7 access to banking services through online platforms and mobile apps.

- Lower Fees: Often have lower fees or no fees at all.

- Higher Interest Rates: May offer more competitive interest rates on savings accounts.

- Innovation: Tend to be more innovative with features like mobile wallets, budgeting tools, and instant payments.

- Transparency: Provide clear and transparent pricing and fee structures.

How do I open an account?

Opening an account is usually quick and easy. You can typically sign up online or via the mobile app by providing some basic personal information and verifying your identity. The exact process may vary depending on the bank and your location.

What if I need help or have a question?

Digital banks offer various customer support channels, including:

- In-app chat: Get immediate assistance through the app.

- Email support: Send an email for less urgent inquiries.

- Phone support: Speak to a customer service representative directly.

- FAQs and Help Center: Find answers to common questions on the website or app.

Can I use my digital bank account internationally?

Yes, many digital banks offer international banking features, such as:

- Multi-currency accounts: Hold and manage multiple currencies in one account.

- International money transfers: Send and receive money globally.

- Low or no foreign transaction fees: Use your card abroad without incurring high fees.

- Access to international ATMs: Withdraw cash in local currency when traveling.

Testimonials

Our Customers

"As a business owner with frequent international transactions, I used to dread the delays and high fees associated with traditional bank transfers. iBAN KING has been a game-changer! Their seamless international transfer service is incredibly fast and cost-effective. I can now send and receive money globally with ease and peace of mind."

Sarah Jones

CEO

Global Exports Ltd.

"iBAN KING's multi-currency account and expense tracking tools have revolutionized how I manage my business finances. I can easily track expenses in different currencies, generate detailed reports and reconcile transactions effortlessly. This has saved me valuable time and improved my financial management significantly."

David Lee

CFO

Hybrid Tech Solutions Inc.

"I love the convenience of managing my finances on the go with iBAN KING's mobile app. It's user-friendly, secure and packed with features. From paying bills to tracking my investments, I can do everything I need with just a few taps on my phone. It's truly banking at my fingertips."

Maria Garcia

Marketing Manager

Creative-X Agency

"I recently had a question about my account and iBAN KING's customer support team was incredibly helpful. They were responsive, knowledgeable and resolved my issue quickly and efficiently. It's reassuring to know that I can rely on their support whenever I need it."

James Chen

Freelance Consultant

-

Our Partners

Stronger Together

Elevate Your Finances With iBAN KING

contact us

Company

Contact Us

Global Presence

Services

FAQs

Testimonials

iBAN KING

Headquarters: 8 The Green Suite A in the city of Dover. Zip code 19901, USA.

Unlimited Remittance Ltd.

licenced In

CANADA

Asimit Remittance Ltd 1224-13351 Commerce Pkwy, Richmond, BC V6V 2X7, Canada holds license No. M23578321 from The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as Money Services Business.

USA

Unlimited Cloud LLC, 10685-B Hazelhurst Dr 18549, Houston, TX 77043, USA holds MSD Registration No. 31000204408346

from Financial Crimes Enforcement Network, of Department of Treasury of the US Government as Money Services Business.

UAE

Asimit Portal Est. Office 202, Saaha offices C, Souk Al Bahar Bridge, Dubai Mall, Downtown Dubai, UAE holds license No. 1376281 from Dubai Economy & Tourism as an online portal for remittances.

QATAR

Unlimited Remit Middle East LLC, QFC Tower 1, 820 Ambassadors Street, 61 Al Qassar/Al Daffna Zone, Doha, Qatar holds fintech license No. 01576 from Qatar Financial Center.

UK

Unlimited Remit Ltd, 85 Great Portland street, First Floor, London, W1W 7LT.

SINGAPORE

Unlimited Cloud Pte Ltd, 68 Circular Road #02-01, Singapore 049422, Singapore.

NEPAL

Lalit Money Transfer Pvt Ltd Unlimited Building, Khichapokhari, PO Box 956, Kathmandu, NEPAL holds a license for Remittances from Nepal Rastra Bank.